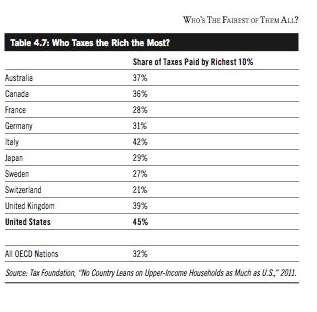

Steve Moore who writes for the Wall Street Journal has written a book entitled: Who's the Fairest of Them All?: The Truth about Opportunity, Taxes, and Wealth in America." He notes that European countries tax their richest 10% at lower rates than the US.

According to Moore, these earners pay almost half (45 percent) of the country's total taxes. This conclusion flies in the face of the liberal concept that top earners in the U.S. are not paying their "fair share" in taxes. Moore explains:Why do Europeans tax the rich at lower rates than the US? I wonder if it's because they realize the wealthy are often business owners who provide jobs. High taxes on these business owners only serves to discourage them from growing their businesses.

"The United States is actually more dependent on rich people to pay taxes than even many of the more socialized economies of Europe. According to the Tax Foundation, the United States gets 45 percent of its total taxes from the top 10 percent of tax filers, whereas the international average in industrialized nations is 32 percent. America’s rich carry a larger share of the tax burden than do the rich in Belgium (25 percent), Germany (31 percent), France (28 percent), and even Sweden (27 percent)."

No comments:

Post a Comment